It uses a single expected value of future cashflows. The traditional valuation technique, known as discounted cash-flows (DCF) or net present value (NPV), requires forecasts. Finally, Section 5 concludes.Įven in the absence of real options there are two main approaches to value investment projects. Section 4 presents two particular applications of the real option approach in investment projects. Section 3 briefly describes three procedures used to solve option valuation problems. Section 2 compares the two main approaches to value investment projects. The remainder of this paper is organized as follows. In particular, this method has been broadened to take into account competitive interactions and their impact on option exercise strategies. Furthermore, the real options approach to valuation is currently being applied in practice and extended in several directions.

Thus, flexibility can be an important component of value for many investment projects and the option-pricing framework provides a powerful tool for analyzing such flexibility. For instance, when a commodity price is low, the firm can choose to close its facility and re-open it later when prices are higher. Finally, the option to temporarily suspend production is valuable whenever a firm has the opportunity to open and temporarily close a facility. In contrast to the traditional approach that uses expected cash-flows to value investment projects, the real option approach takes into account the entire distribution of cash-flows, allowing the firm to react/respond during the course of the investment. Furthermore, the option to abandon a project is important and valuable in research and development (R&D) investments as it provides the flexibility to abandon a project in the presence of negative outcomes. On the other hand, even with a positive NPV project, the option to delay the investment is valuable as it gives the firm the opportunity to wait until more market information is available. In this case, the option to expand is valuable and must be considered when quantifying the value of the mine. This investment will provide the option to develop the remainder of the mine when and if market prices change. Consider the valuation of a mine of which, at current commodity prices, only half is economically feasible for development.

For example, the option to expand a project is valuable when a firm may want to invest in a negative net present value (NPV) project if it provides the firm the possibility of developing a new project. There are four main types of options associated with investment projects-the option to expand, to postpone, to abandon, and to temporarily suspend an investment.

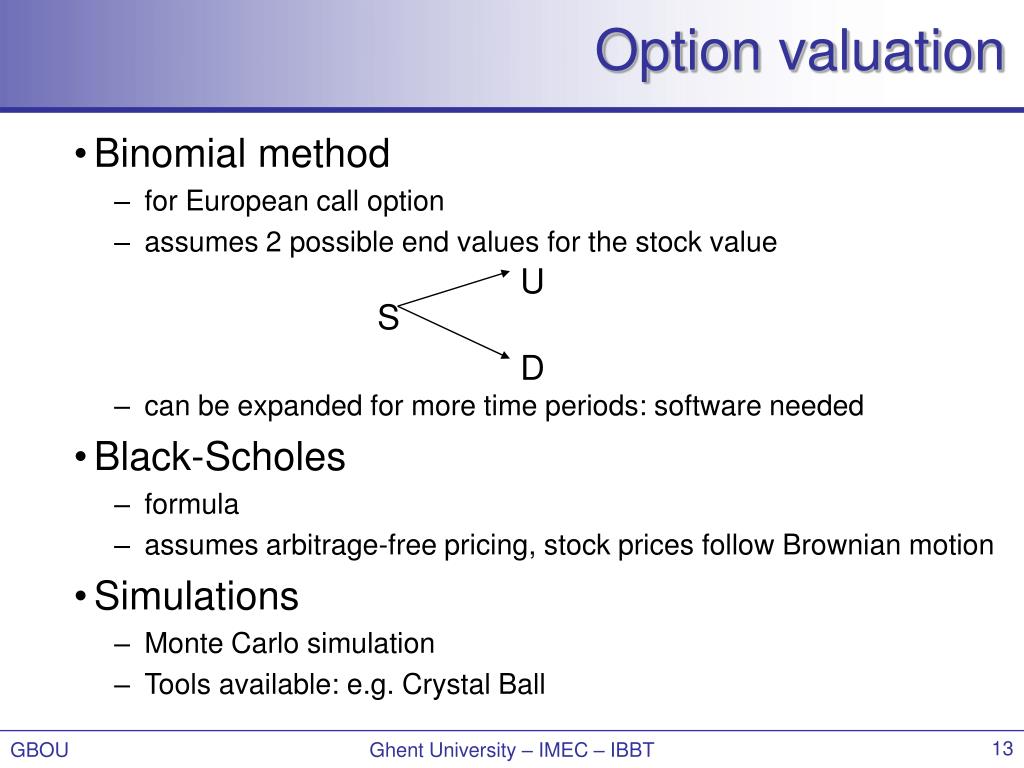

Most investments are subject to options valuation. Whenever possible, real options valuations are aligned with financial market valuations. Uncertainty and the agent's ability to respond to it (flexibility) are the source of value of an option. Options are contingent decisions that provide the opportunity to make a decision after uncertainty unfolds. The real options approach is an extension of financial options theory to options on real/non-financial assets. Two applications of the real options approach are discussed in more detail: the valuation of natural resource investments and the valuation of research and development investments. Recent developments in the valuation of complex American options has allowed progress in the solution of many interesting real option problems. After a general introduction to the subject, numerical procedures to value real options are discussed. Email: paper provides an overview of the real options approach to valuation mainly from the point of view of the author who has worked in this area for over 30 years.

** California Chair in Real Estate and Land Economics Professor of Finance, Anderson School of Management, University of California, Los Angeles. Hay Jin Kim provided valuable assistance. * This lecture was delivered at the 2013 Finance UC Conference in Santiago, Chile. THE REAL OPTIONS APPROACH TO VALUATION: CHALLENGES AND OPPORTUNITIES *

0 kommentar(er)

0 kommentar(er)